Grants for Black, Hispanic-owned businesses are disappearing

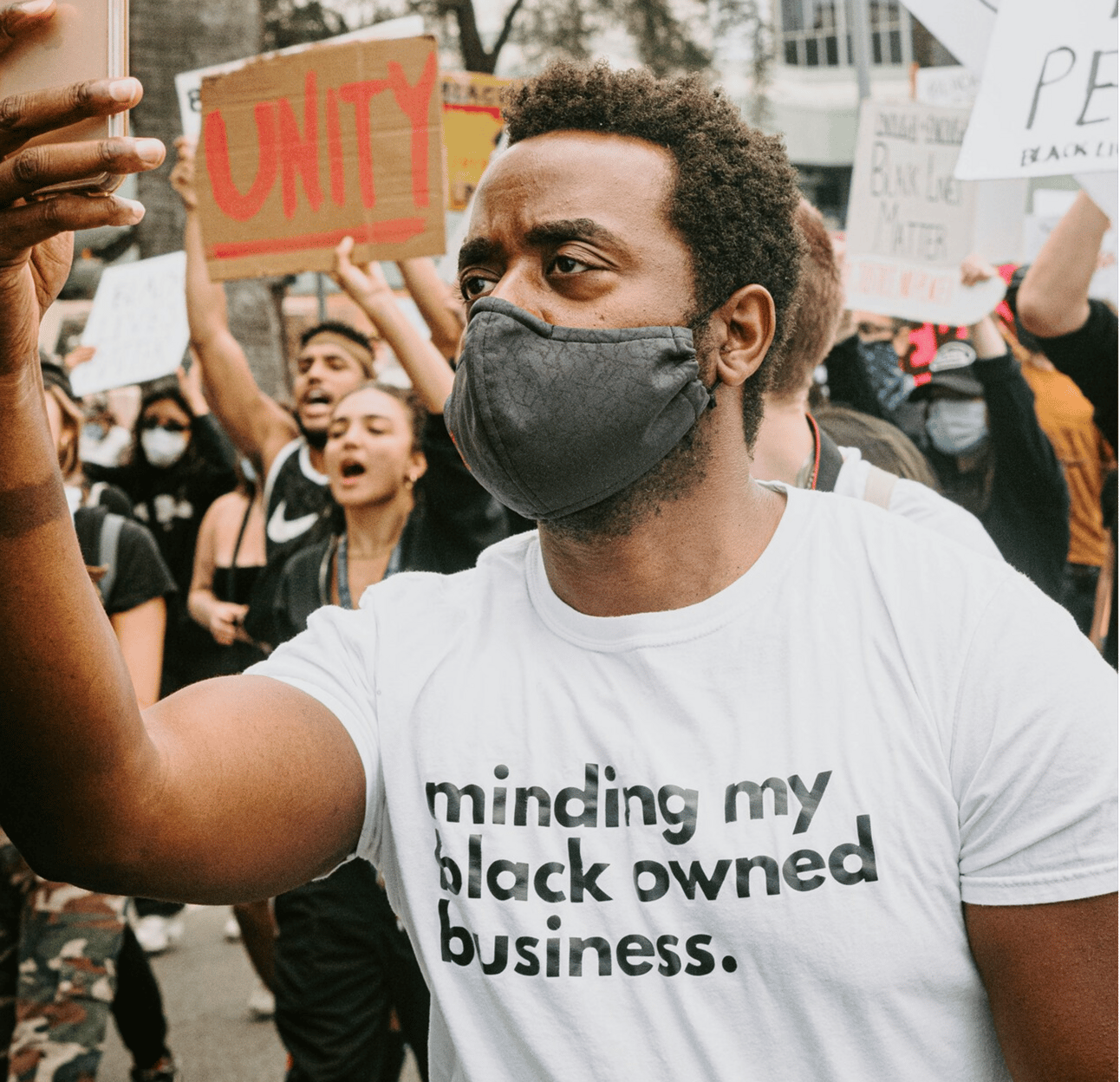

Grants for Black-owned businesses are disappearing as lawsuits target the funds that dispense them. Photo by Freddy Kearney on Unsplash

What you probably already know: A lawsuit filed earlier this year that aimed to prevent organizations from using race as a factor in determining who gets philanthropic support or small business grants ended in a settlement last month. The agreement forced the organization handing out the grants to Black women-owned businesses to shut the program down. But the impact will be much more wide-spread. More than 40% of small business grant programs that included race or ethnicity in their criteria have disappeared in the last year, and another 27% of them have stopped using race or ethnicity as a factor in awards, according to research by Skip, a small business funding platform.

Why? The litigation, filed by billionaire businessman Edward Blum and his Alliance for Equal Rights, targeted the Fearless Fund, an Atlanta-based organization that provided loans and grants to Black-owned businesses. Blum’s firm is the same group that successfully overturned affirmative action in higher education. To be clear, as Stephanie Ellis-Smith told Formidable earlier this year, focusing investments and grants on women and people of color is not illegal. Despite that, it’s clear that organizations large and small that provide support for these kinds of businesses are pulling back out of fear they’ll find themselves in the crosshairs.

What it means: Progressive, the insurance company, and many other larger companies have broadened their small business support programs and removed references to race or gender out of fear of being targeted by legal or social campaigns. Most of these programs hand out small awards, generally under $20,000, that can be the difference for small businesses looking to scale at critical moments. They also tend to fill in the gap left by traditional lending institutions. About 33% of Black and Hispanic-owned businesses receive the loans they request, compared to more than 50% of white-owned businesses. Those same groups get less than 1% of all venture capital investments.

What happens now? Many of these initiatives emerged after the murder of George Floyd put in the spotlight the unequal opportunities for underrepresented groups. Banks and other organizations rushed to update their programs to focus on these groups, only to now roll them back only a few short years later. The shift comes as other diversity programs, including DE&I initiatives and ESG work, have been rolled back as investors and other groups target these programs via social media campaigns and activist investor filings.