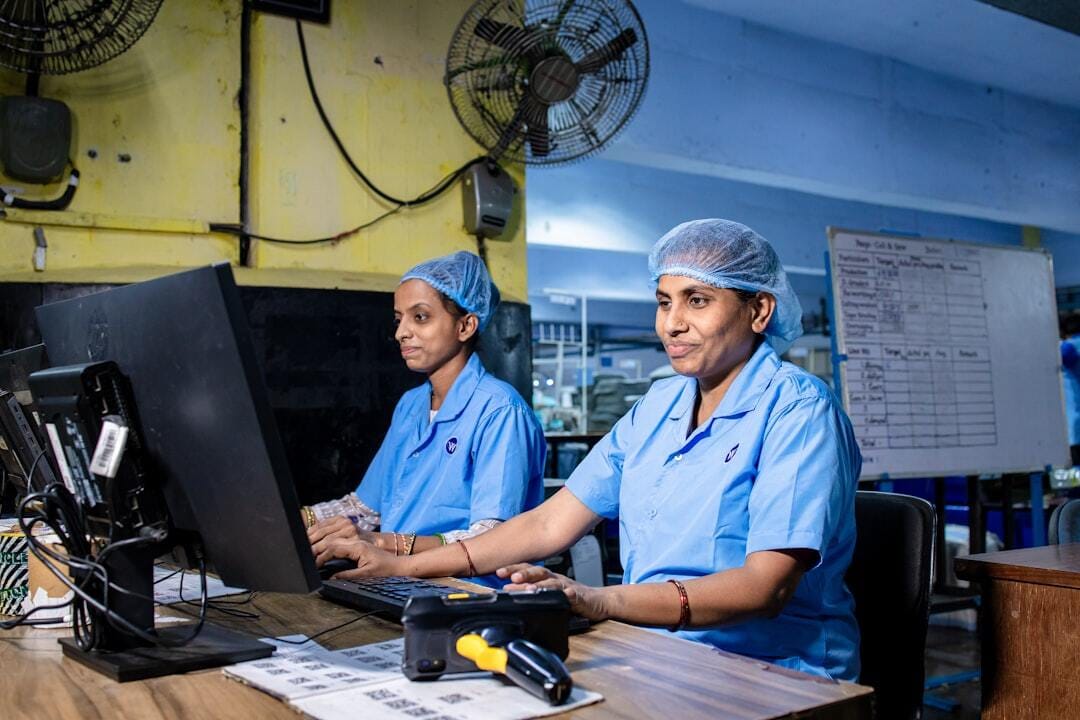

Investors are cashing in on women’s health. | EqualStock photo on Unsplash.

What you probably already know: In what it calls the first comprehensive analysis of company exit values in women’s health, health company AOA DX finds that exits have exceeded at least $100 billion in the past 25 years, with 27 billion-dollar deals. The report, called “Follow the Exits, Why Women’s Health is a Smart Bet in Healthcare,” examined 276 exits (M&A or IPO transactions), with diagnostics as the highest-performing category. Nearly half of those exits have happened in the past five years alone, though the analysis points out that women’s health exits have historically been underreported.

Why it matters: It’s a myth that innovation is limited to fertility, with the report calling women’s health “a maturing market with accelerating momentum. It’s not that women’s health lacks opportunity — it’s that our lens has been too small to see it.” Though diagnostics (especially oncology and molecular platforms) achieved an exit value 2.3 times higher than the industry median, other technologies driving exits include medical devices, biopharma, female-focused digital health and companies that span more than one category. A McKinsey study finds that most of women’s total disease burden comes from conditions that aren’t exclusive to female biology, yet they remain underdiagnosed, undertreated and underfunded.

What it means: “Better data and visibility reveal the true scale of women’s health, “says Elyse Blazevich, president and CEO of the Colorado BioScience Association. “It’s an established, high-growth sector driving innovation, delivering investor value, and improving and saving lives worldwide.” The report notes that many of the exists involved “repeat acquirers,” including major companies such as Labcorp, Roche, Medtronic and Allergan, “reinforcing women’s health as a priority growth area across diagnostics, devices and services.” Last year was the biggest on record, with more growth on the horizon.

What happens next: The report predicts the next wave will focus on gynecologic oncology, precision diagnostics, menopause and chronic disease, noting that “momentum is increasing, not plateauing.” Specifically, opportunities exist in companies studying Alzheimer’s disease (two-thirds of Alzheimer’s patients are women); GLP-1 agonists (“a metabolic market led by women”) and cardiac disease, where women account for half of all deaths yet make up only about one-third of clinical trial participants. “As capital markets, strategic acquirers and founders increasingly align around earlier detection and precision care,” says Katherine Anderson, head of Life Science & Healthcare at HSBC Innovation Banking, “women’s health is proving to be a category where innovation translates into repeatable liquidity and long-term value creation.”